Alaska’s Controversial Pebble Exploit Is Lifeless Not anymore. FRONTLINE

Posts

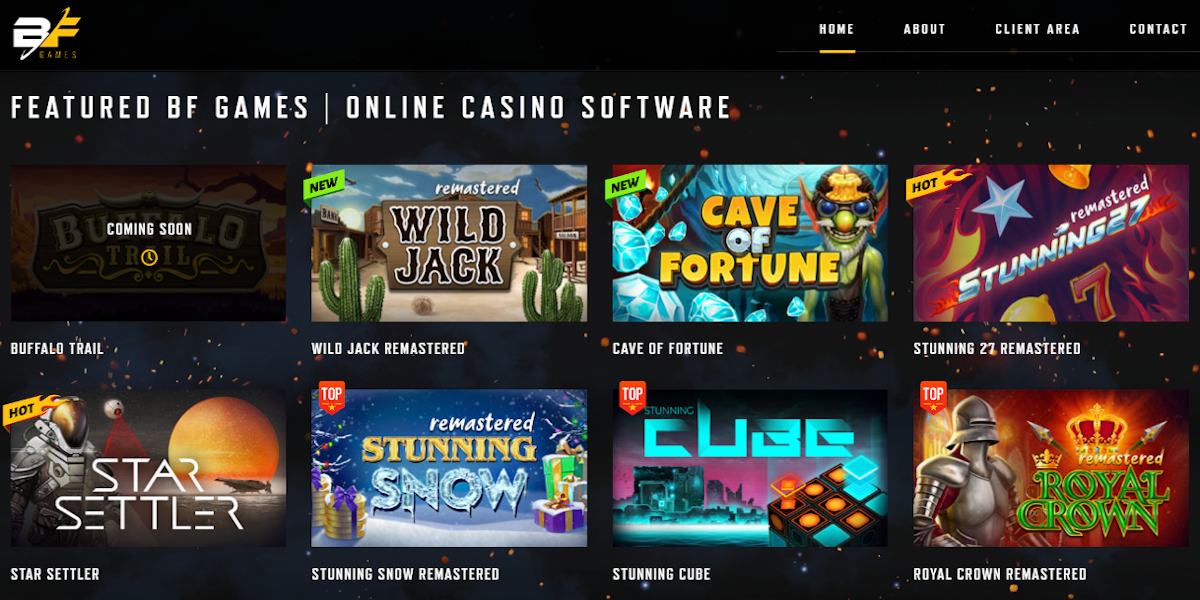

Extra.com is actually a comprehensive gambling on line investment giving tested and you can verified advertisements, objective reviews, professional courses, and community-best development. I in addition to hold a robust dedication to In control Gambling, so we just defense legally-registered companies so that the highest number of athlete defense and protection. One of several the newest rages of one’s “video slot” world is available in the form of expertise games, having a completely independent strategy.

🇸🇪 Plagazi signs €30.5 million give arrangement to your Eu Development Money

The fresh management error variations corrects the amount claimed to the Form 941, Mode 943, or Mode 944 to help you concur with the amount indeed withheld out of group and you can said on their Variations W-dos. Do not install the newest statement in order to create 941, Setting 943, otherwise Setting 944. Understand the Standard Instructions to have Models W-2 and you may W-step 3 to own here is how in order to statement the newest uncollected staff display of public protection and you will Medicare taxation to your info and you can classification-life insurance for the Function W-dos.. Never declaration copy withholding or withholding to your nonpayroll money, such as pensions, annuities, and you can gambling payouts, to your Versions 941, Mode 943, or Setting 944. Withholding to the nonpayroll money is actually advertised on the Versions 1099 otherwise W-2G and ought to be stated for the Mode 945. Merely fees and you may withholding stated for the Setting W-dos might be advertised for the Forms 941, Function 943, or Mode 944.

Designating the main happy-gambler.com hop over to the website benefit as the an “opportunity relief percentage” is expected to really make it exempt of government taxation. The remainder of the brand new bonus has been susceptible to federal income tax. Designating the benefit as the a keen «times rescue payment» is expected making it excused of government taxation.

Debateable company: Shrubs control because the environment alter rearranges Arctic biodiversity

The fresh silent, chill waters away from Alaska’s In to the Passageway may be the perfect environment so you can individual humpback whales. All of our site visitors let us know private things with this quiet creatures provides altered the way they see the community – so we find out what they strongly recommend. A lot of the ponds and you may canals in the Interior Alaska might possibly be achieved from the air or even motorboat, however some try path-for your needs, especially in the fresh Fairbanks town. We are going to matches your own with a local itinerary professional to plan your trip.

- The remaining $298.17 is actually paid for with extra petroleum money earliest earmarked inside the 2023.

- Such as, medical professionals, attorneys, veterinarians, and others in the an independent trade in which they offer its services for the public are often maybe not personnel.

- Particularly, AIDEA’s mission because of it venture is always to help nutrient investment exploration and you can development in the new Ambler Exploration Area.

- The new referendum will not put on dedications away from revenue, to appropriations, to regional otherwise special laws, or to regulations very important to the newest instant maintenance of your public peace, fitness, otherwise shelter.

For additional information from the employer withholding conformity, see Irs.gov/WHC. Regular staff and you will group not currently carrying out features. Withholding on the extra wages when a worker obtains over $one million of extra earnings from you in the calendar year. The government per diem rates to possess food and you will rooms on the continental All of us can be obtained by visiting the brand new You.S.

To your Function 499R-2/W-2PR, go into the quantity of uncollected public defense and you can Medicare fees in the boxes twenty five and twenty-six, correspondingly. Never tend to be one uncollected Extra Medicare Tax within the container a dozen of Setting W-2. To learn more about revealing information, come across point 13 as well as the General Tips to possess Versions W-dos and W-3.

Staff also have the option in order to writeup on their 2025 Setting W-4 other earnings they’ll discover this isn’t subject to withholding or any other write-offs they will allege to help you help the reliability of the federal taxation withholding. If you shell out extra wages which have normal wages but don’t establish the level of for each and every, keep back federal income tax as if the complete was a single percentage to own an everyday payroll several months. The value of meals isn’t really nonexempt earnings and you may actually susceptible to federal income tax withholding and you can public defense, Medicare, and you may FUTA taxation if your foods are furnished on the employer’s convenience as well as on the newest employer’s premises. The worth of lodging isn’t subject to federal income tax withholding and you can personal shelter, Medicare, and you will FUTA taxes if your hotels try furnished on the employer’s convenience, on the employer’s site, and as a condition away from work. Zero government taxation withholding to your impairment payments to possess injuries sustained since the a result of a radical assault directed against the Us.

If not, ignore any then Models W-cuatro available with the new staff and you will keep back based on the Irs find or modification find. You may also refund your staff by the travelling days, miles, or other repaired allocation beneath the relevant revenue techniques. In such cases, your own worker is known as for accounted for your requirements if the reimbursement will not meet or exceed cost dependent by federal government. The high quality mileage rate to have auto expenditures is provided inside the Club. Quantity paid less than a responsible bundle are not earnings and aren’t subject to help you income, public security, Medicare, and FUTA taxes. A refund otherwise allowance plan is actually a system where you spend the money for enhances, reimbursements, and you will costs for your own employees’ team expenditures.

![]()

For more information on all the information your’ll have to give debt business making a same-time wire payment, visit Internal revenue service.gov/SameDayWire. If you have more than step one spend go out through the a semiweekly several months as well as the spend dates fall-in various other calendar residence, you’ll want to make independent dumps for the separate obligations. For those who file Mode 943 and therefore are an excellent semiweekly plan depositor, done Function 943-A good, Farming Employer’s Checklist out of Federal Income tax Liability, and you will complete it which have Mode 943. For individuals who file Mode 944 or Setting 945 and they are an excellent semiweekly plan depositor, over Form 945-An excellent, Yearly Listing from Federal Tax Liability, and complete it together with your return.. A different of personal defense and you may Medicare fees can be obtained to help you people in a respected spiritual sect go against insurance.